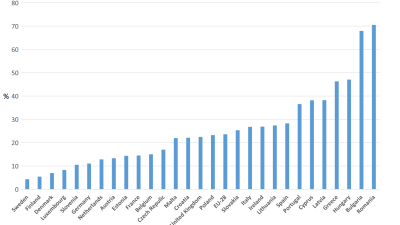

of households have a 'constant struggle' to keep up with bills

Financial insecurity is an issue that affects many households across Northern Ireland. A culmination of increases in the cost of living accompanied by a fall in earnings from employment has led to sharp falls in household income with living standards for households in the UK now below those of 2004-2005 (IFS, 2012). 13% of households in Northern Ireland consider they are ‘a lot below’ the level of income which they say would keep them out of poverty. Credit and borrowing plays an important part in people’s lives; participants borrow from family members, moneylenders and a number of other credit sources including the Credit Union, credit cards, catalogues and vouchers for day-to-day needs and to meet unexpected demands on the family budget.

Watch a film about debt and financial insecurity and its impact, made by the Ardoyne Communities in Action focus group.

This film is the copyright of Grace Women's Development Ltd and the CiA Collaboration.

For many people, debt repayments place severe pressure on family budgets.

For a £1000 loan you’re paying £1800 back . . .

Participant, Ardoyne, Belfast

Most communities are concerned about the proposed shift from weekly to monthly payments under Universal Credit and how this will affect their ability to make ends meet. Weekly budgeting is common across all community groups, as people feel they have greater control over their money. For example people may pay for fuel to heat their house weekly, as while it may be more expensive than monthly payments, it is more manageable and people are not hit by large quarterly bills they cannot afford. This enables people to cover the cost of unexpected but necessary expenses like a new winter coat or shoes. In Northern Ireland 43% of people could not afford to pay for an unexpected but necessary bill of £500 and a third of adults are unable to regularly save £20 a month for rainy days.

Debt and financial insecurity is an issue that the CiA communities have decided to focus on as a common concern. They have raised this issue with politicians in Stormont and the community film on the cycle of debt facing some families has also been shown to an MEP. The CiA and Community Foundation for Northern Ireland (CFNI) will be linking with other groups in Northern Ireland to address the issue of high interest loans. This focussed work is a direct outcome of communities’ research.

If something goes wrong, like your washing machine breaks, you’re running about trying to borrow money.

Participant, Cregagh, Belfast

Read the first CiA In-brief report on debt and financial insecurity, Scraping by from week to week.

To find out more about people’s experiences of debt and financial insecurity download the excerpt from the first full CFNI report on community focus groups below.

Further in-depth analysis on debt and financial insecurity in Northern Ireland will be released by Queen’s University over the coming months. Visit the PSE Research section for more information on the PSE’s Northern Ireland research.

Find out what people in Northern Ireland think are basic necessities for adults and for children on the PSE Research heatmaps for adults and children.

Visit the Communities in Action project website for more information.

PSE:UK is a major collaboration between the University of Bristol, Heriot-Watt University, The Open University, Queen's University Belfast, University of Glasgow and the University of York working with the National Centre for Social Research and the Northern Ireland Statistics and Research Agency. ESRC Grant RES-060-25-0052.

PSE:UK is a major collaboration between the University of Bristol, Heriot-Watt University, The Open University, Queen's University Belfast, University of Glasgow and the University of York working with the National Centre for Social Research and the Northern Ireland Statistics and Research Agency. ESRC Grant RES-060-25-0052.