The coalition government’s proposal to strip nearly £4 billion from the welfare bill by capping increases in benefit levels to 1%, well below inflation, marks another shift towards a welfare system that is no longer fit for its fundamental purpose of protecting those in need.

The move is a significant departure in the post-war history of welfare in the UK and is, indeed, unprecedented since the war. The last deliberate political move to lower the real incomes of the poorest members of society was more than eighty years ago in 1931. Then attempts to cut benefits for the unemployed split the cabinet and led to the collapse of the Labour government under Ramsey MacDonald. The uprating bill, before Parliament on January 8, 2013, raises a vital question: why should the poor pay the price for the failure of Britain’s economic model to deliver enough jobs and decent wages.

The current measure is merely the latest in a number of moves towards a more punitive approach to welfare for those of working age. To date, those who have been most badly affected by successive cuts in the relative level of benefits have been the jobless. As a result, the UK has slipped down the rich world’s league table on the effectiveness of jobless benefits. Its unemployment benefit ‘replacement rate’ (the proportion of earnings met by benefit) is already one of the meanest amongst rich countries. The OECD’s tax-benefit models show, for example, for a married couple with two children on average earnings, benefit rates meet 53 per cent of former net earnings compared with an OECD average of 76 per cent.

As Professor Jonathan Bradshaw of York University has shown, between 1948 and 1979 unemployment benefit doubled in real terms and rose slightly in relation to average earnings reaching 21% in the late 1970s. Since 1979, that trend has been sharply reversed – the benefit has been raised (along with other benefits) only in line with prices. As a result, the level of jobseeker’s allowance has halved as a percentage of average earnings: and now stands at a lowly 11%.

Even this minimalist rule – linking benefits merely to prices - is now to be broken by the uprating cap. Benefits – for the low paid as well as those out of work - will fall in real terms in each of the next three years. The resulting savings of £3.8 billion mean an equivalent cut in the living standards of the poorest in society. Since it is unlikely the real value of benefits will be subsequently restored, this will mean a permanent reduction in the value of benefits and a further leveraging of the gap between the poorest and the better off, and between different groups of benefit recipient. Pensioners, for example, are to be protected with the state pension to rise by 2.5% this year.

Underlying these policy shifts has been a successive failure of economic management. As a result, Britain’s welfare system has come to play a greatly extended role, way beyond its original aims. The sustainability of the Beveridge reforms and limiting the role of welfare were always dependent on achieving full employment and a decent wage floor. Both were broadly met up to the early 1970s.

Over the last thirty years, however, wider labour market trends have forced welfare into a role for which it was never designed – that of a safety net for the growing inability of the economic system to provide decent livelihoods and work opportunities for a rising proportion of the workforce. Unemployment since 1980 has averaged more than three times that of the two post-war decades, while the proportion of those in low paid jobs (at wages less than two-thirds of the median) has almost doubled to more than 21%. This is the second highest rate (behind the US) amongst rich countries.

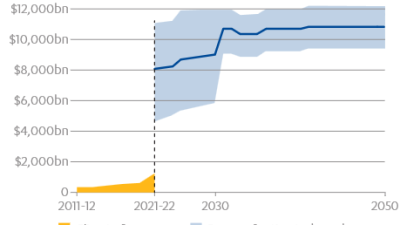

The cost of welfare has soared in the UK largely because it has become a prop for the failures of the Anglo-Saxon model of market capitalism. Since 1980, the share of output going to wages has been shrinking with the fall concentrated amongst those on low earnings. It is these labour market trends that have driven an ever expanding welfare bill. Every fall of a pound in gross wages amongst the bottom third of the distribution brings a hike in the cost to government (in higher benefits and lower taxes) of slightly less than 50p.

In cutting this bill (and thus raising the level of poverty) this latest measure also brings a further weakening of this prop. We now have an economic model that is unable to produce enough jobs at decent wages and a welfare system no longer able to compensate for this failure. As John Veit-Wilson has argued, this is driving Britain back towards the Poor Law philosophy of the Victorian age, an era of mass low pay in which claimants had few rights and benefit levels were set so low that the jobless had little choice but to take low paid work.

The government’s latest clampdown marks a further shift towards a welfare system that is fast losing its fundamental purpose, to protect those most in need. One longer-term side-effect of the 1931 political fallout over benefit cuts was a debate that eventually led to the Beveridge reforms. Today’s vote on the Welfare Benefits Uprating Bill is also likely to trigger a new urgency for a root and branch reform that provides a welfare system fit for today’s more turbulent times and which does not penalise the poor and the unemployed for a failed model of capitalism. Such a discussion is already under way with the debate on ‘pre-distribution’: on how to create a more equal pattern of wages before the application of taxes and benefits. That now needs to be matched by a parallel debate on the role of welfare.

Stewart Lansley is a member of the PSE research team and the author of the Cost of Inequality, Why Economic Equality is Essential for Recovery, Gibson Square, 2012.

PSE:UK is a major collaboration between the University of Bristol, Heriot-Watt University, The Open University, Queen's University Belfast, University of Glasgow and the University of York working with the National Centre for Social Research and the Northern Ireland Statistics and Research Agency. ESRC Grant RES-060-25-0052.

PSE:UK is a major collaboration between the University of Bristol, Heriot-Watt University, The Open University, Queen's University Belfast, University of Glasgow and the University of York working with the National Centre for Social Research and the Northern Ireland Statistics and Research Agency. ESRC Grant RES-060-25-0052.