Governments are capable of reducing income inequality despite countervailing behavioural responses, according to a research paper from the Centre for European Economic Research in Mannheim.

The paper uses a panel of industrialised OECD countries over the period 1981-2005 to analyse the effect of redistributive policies on post-tax inequality.

Key findings

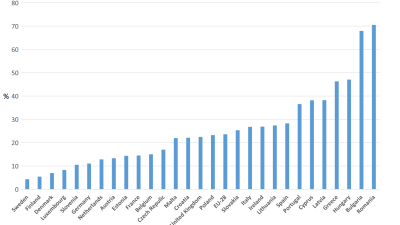

- The Gini coefficient (a widely used measure of inequality) has increased since the early 1980s, after a downwards trend between the 1960s and 1980s.

- Radical and liberal welfare states are characterised by more inequality than social democratic or conservative ones – hinting, the researchers say, that institutions seem to matter for the income distribution. The large rise in inequality in eastern European states since the break-up of the Soviet bloc adds to this presumption.

- Despite 'behavioural feedback' effects, there is some empirical evidence that government spending and (in particular) social expenditure meet the target of reducing inequality as measured by the Gini coefficient. A one per cent increase in spending is roughly related to a 0.3 per cent drop in inequality.

- Government expenditure seems to matter more for reducing inequality than the degree of progressivity in the tax system. Higher tax progressivity leads to stronger behavioural effects, which tend to increase pre-tax inequality and hence offset the inequality-reducing direct effects.

- Whereas the USA has a very progressive income tax schedule, very little redistribution occurs through social benefits. In contrast, European welfare states rely (on average) much more on benefits, and government expenditure more generally, to fight inequality. The introduction of the earned income tax credit (EITC) in the USA has reduced inequality without large disincentive effects, and expanding the EITC and other benefits might be a fruitful way forward in order to combat rising inequality.

Source: Philipp Doerrenberg and Andreas Peichl, The Impact of Redistributive Policies on Inequality in OECD Countries, Discussion Paper 14-012, Centre for European Economic Research (Mannheim)

Links: Paper

PSE:UK is a major collaboration between the University of Bristol, Heriot-Watt University, The Open University, Queen's University Belfast, University of Glasgow and the University of York working with the National Centre for Social Research and the Northern Ireland Statistics and Research Agency. ESRC Grant RES-060-25-0052.

PSE:UK is a major collaboration between the University of Bristol, Heriot-Watt University, The Open University, Queen's University Belfast, University of Glasgow and the University of York working with the National Centre for Social Research and the Northern Ireland Statistics and Research Agency. ESRC Grant RES-060-25-0052.